Iran’s currency crisis: what the rial does (and does not) tell us

The recent nationwide protests in Iran are the result of an accumulation of grievances, increasingly focused on what is commonly described as the “loss of value of the national currency.” This phrase is a familiar everyday lament among Iranians, who often equate the value of the rial—measured in U.S. dollars—with living standards. In doing so, they typically focus on the free-market exchange rate. Although this is a narrow market, it produces the most dramatic signal. The bulk of foreign exchange transactions take place at lower rates, but access to them is limited. The free-market rate, now around 1.3 million rials per dollar and averaging just under one million in the past month (see the blue line in Figure 1, left axis), is roughly 100 times its level when Obama-era sanctions took effect in late 2011.

(more…)Rethinking CPI, Food Prices, and Living Standards in Iran

A comment from an informed reader prompted me to re-examine my earlier post on living standards in 2024/25. The issue raised was whether it is adequate—or even accurate—to deflate household expenditures with the overall CPI, as reported by the Statistical Center of Iran (SCI), while ignoring the fact that food prices have risen faster than average prices.

(more…)Household Survey Data Reveal Modest Gains in Iran’s Living Standards for 2024/2025

The recently released microdata from Iran’s Household Expenditures and Income Survey (HEIS) offers valuable insights into household economic conditions across the country during the Iranian year ending on 20 March 2025 (Iranian year 1403 or 2024 for short). This post updates my earlier post on Iranian living standards in 2023.

(more…)The US-Israel war on Iran revives inflation fears

Kudos to the Statistical Center of Iran for not missing last month’s inflation report (Khordad = 21 May-20 June), despite the destruction caused by the Israeli bombing of Tehran. The attack struck at the heart of Tehran, a few blocks from SCI’s main building. Significantly, for those who habitually question Iran’s official statistics, the report is not flattering.

(more…)Iran’s GDP on the eve of the Israeli attack

I was planning to write an update on the state of Iran’s economy when Israel attacked Iran on June 13. For several days, it felt pointless to continue analyzing economic data — not because the data had become irrelevant, but because war had pushed the economy off center stage. Monitoring economic trends had mattered when Iran’s economic condition shaped its geopolitical posture. At that time, I saw value in challenging distorted narratives, those claiming that the economy was teetering on the brink of collapse — perhaps to justify preemptive military action — as well as those claiming Iran was thriving under sanctions, a blessing as some hardliners in Tehran liked to describe them.

(more…)Iran’s Investment Puzzle: Diverging Data, Converging Concerns

In a recent post, I discussed the rising standard of living in recent years and questioned how that could persist while the share of investment in GDP has been falling. Not only has it been falling, but to levels that seem inadequate for maintaining the capital stock—and with it, the quality of essential services like electricity. This is clearly unsustainable. If investment drops below 10 to 15 percent of GDP, the country would essentially be consuming by running down its capital—much like a household that sustains itself by selling off its furniture.

(more…)Sanctions and unequal regional growth in Iran

Regional equity is crucial in a centralized yet multi-ethnic country like Iran. In the language of empirical growth literature, convergence allows poorer regions to catch up, moving the country toward a more balanced standard of living. This process strengthens national unity by ensuring that no region is left behind. In contrast, divergent growth, where disparities widen over time, risks pulling regions apart and undermining national cohesion.

(more…)Trump’s return shocks Iran’s currency and prices

With Trump’s return to power, Iran is bracing for another round of maximum pressure. The rial has already fallen by one-third in the unofficial free market since last November, when his victory was announced. As before, the sharp devaluation has quickly translated into higher prices and rising social tensions.

(more…)New data reveal rising living standards in Iran

The latest data files for the 2023/2024 (1402) Household Expenditure and Income Survey (HEIS) just became available on the website of the Statistical Center of Iran (SCI). SCI had already published its summery results (in Persian) a couple weeks ago, showing considerable increase in nominal incomes (53.9 and 51.4 percent for urban and rural households, respectively) and expenditures (55.9 and 45.4 percent). Given the year’s inflation of about 40%, these numbers indicate considerable increases in real incomes and expenditures.

(more…)Positive economic news buoys Iran’s new president ahead of UN visit

Iran’s new president, Masoud Pezeshkian, is in New York this week to attend his first UN General Assembly meeting. His foreign policy team, led by foreign minister Abbas Araghchi, is with him hoping to resurrect the all-but-dead nuclear talks. Pezeshkian’s success in his first term depends on easing, if not ending, US sanctions. In seeking talks with the West, two recent pieces of positive economic news help dispel the notion that Iran is seeking to resume negotiations because its economy is tanking. They will not convince those who wish to interpret Pezeshkian’s election and his reaching out to the West as signs that sanctions are finally doing their wrecking job and it is therefore time to wait as Iran’s position softens. But, for the record, there is some positive news.

Two key economic indicators bolster Iran’s position as it engages with skeptical Western diplomats:

- Inflation: Last month (the Iranian month ending September 20), prices rose at a 22% annual rate, marking the third consecutive month of inflation below 30%.

- Economic growth: Despite sanctions, Iran’s economy grew by 4.5% in the 2023/24 Iranian year and by 3.3% during spring this year.

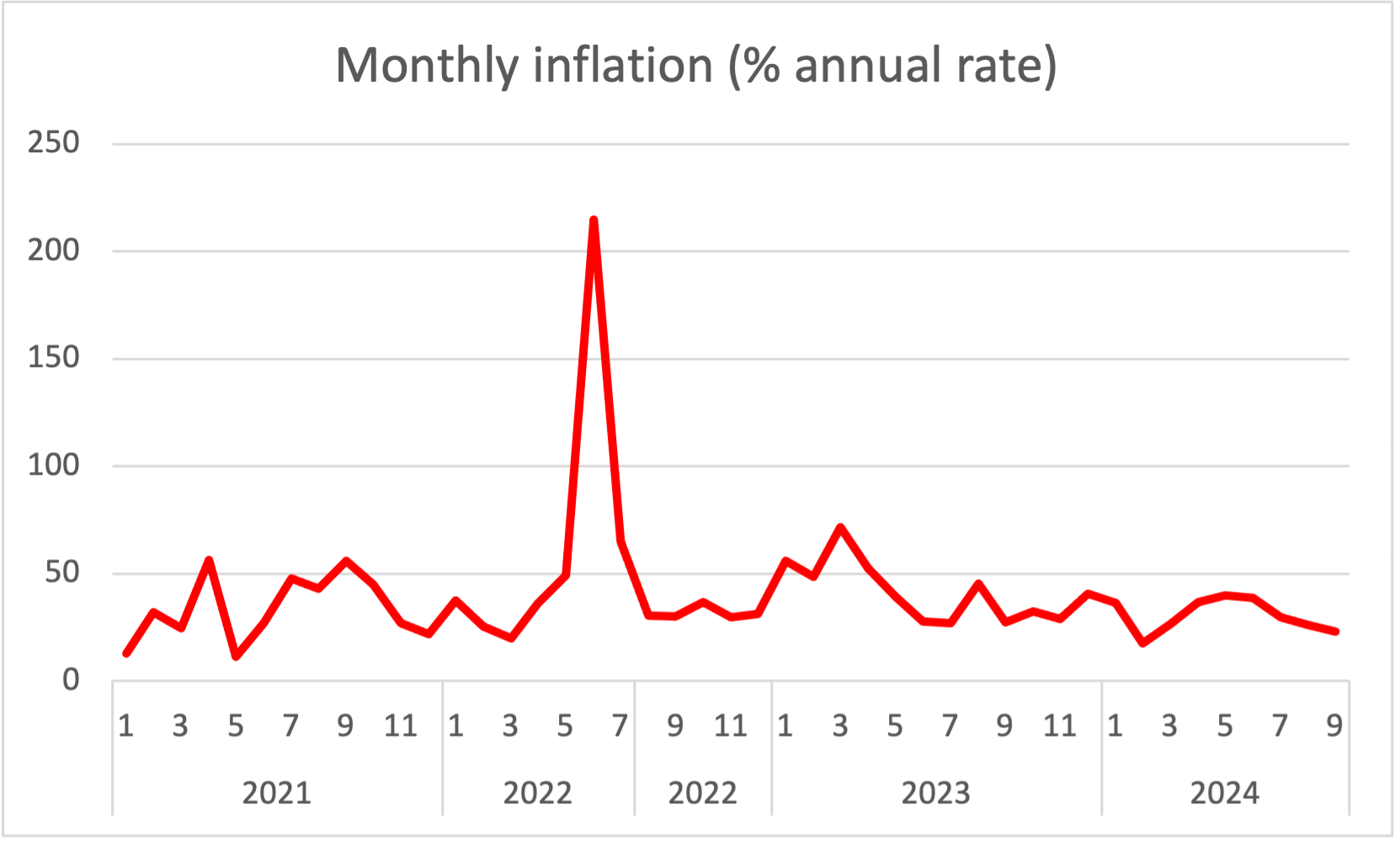

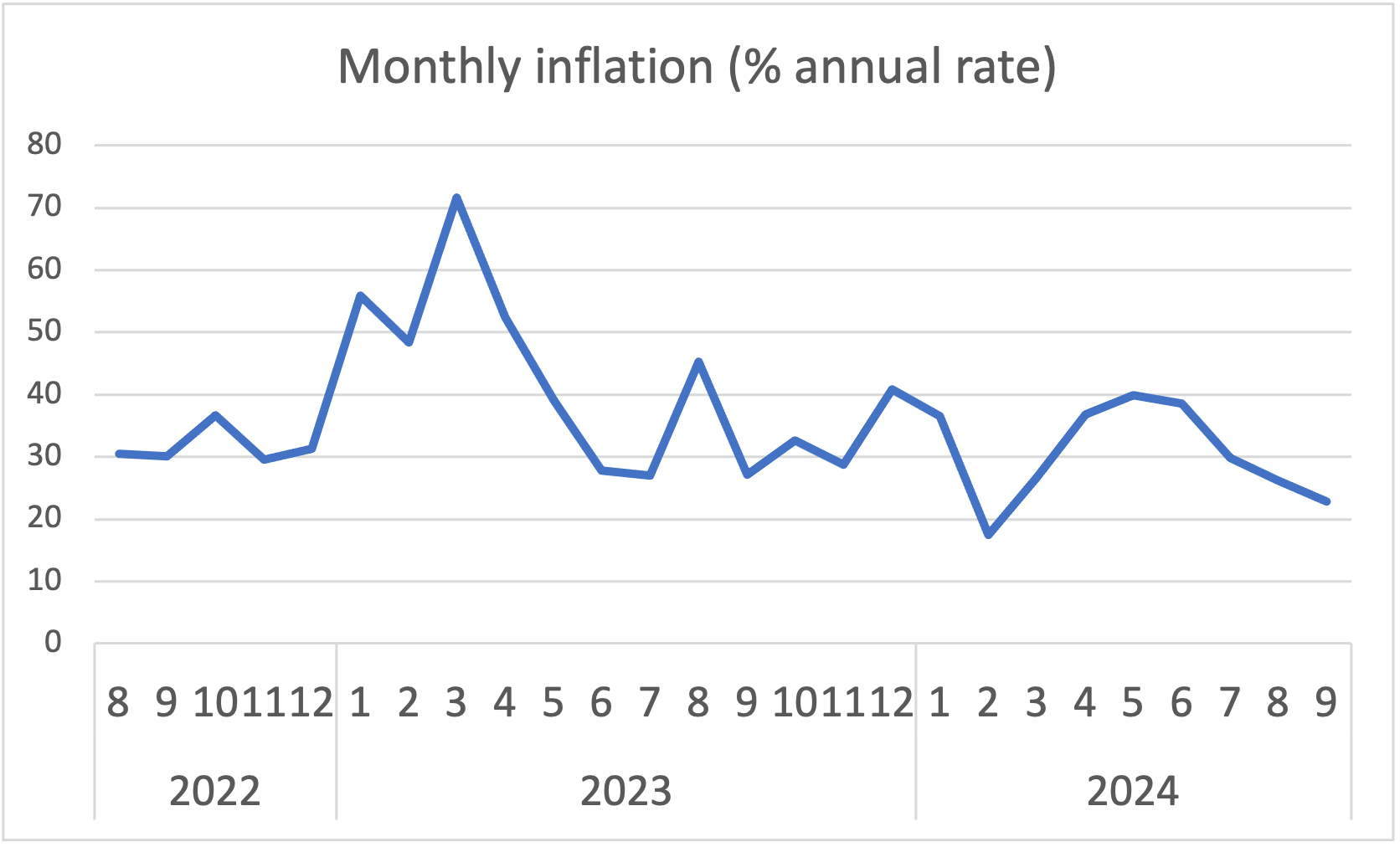

To appreciate why a 22% inflation can be good news, consider that less than two years ago, in June 2022, prices surged at a record annual rate of 214% (Figure 1, left panel) following the removal of the exchange rate subsidies. As recently as 18 months ago, inflation was still above 50% annually (see the right panel). The crucial question now is what factors are driving this slowdown. Possible explanations include tight monetary policy (which has frozen real estate transactions), rising supply of foreign exchange (oil production was up), and improved budget discipline. Understanding which of these factors played a role will indicate whether the slowdown is likely to continue.

Turning to economic growth, the reasons behind the modest recovery are equally unknown. The Central Bank report containing the new economic data recites the numbers without providing in-depth analysis. Available figures suggest that, as in the past three years, growth has been led by the oil and gas sector, which expanded by 14.7% last year and 9.5% in spring. Manufacturing has been also growing, but slowly and not commensurate with the stimulus it has received from currency depreciation — up by 4.4% last year and 3.1% last spring. Non-oil GDP grew by 3.6% last year and 2.5% in spring.

No one should expect the election of a moderate Iranian president or signs of continued economic recovery in Iran to signal an imminent end to decades of hostilities between Iran and the West. This is particularly true with ongoing conflicts in Ukraine and Palestine, where the two sides are at odds. However, it does prompt a reevaluation of continued reliance on the West’s favorite weapon — sanctions — to persuade Iran to halt its nuclear enrichment or to cooperate with the West in promoting regional stability.

Correction made on 9/26/24: 2022/23 changed to 2023/24 for GDP growth, in second paragraph.

4 comments