New data reveal rising living standards in Iran

The latest data files for the 2023/2024 (1402) Household Expenditure and Income Survey (HEIS) just became available on the website of the Statistical Center of Iran (SCI). SCI had already published its summery results (in Persian) a couple weeks ago, showing considerable increase in nominal incomes (53.9 and 51.4 percent for urban and rural households, respectively) and expenditures (55.9 and 45.4 percent). Given the year’s inflation of about 40%, these numbers indicate considerable increases in real incomes and expenditures.

But the SCI report is at the household level and welfare should be measured at the individual level, so I use the unit record data to recreate do the analysis at the individual level. Here is what I find.

First, I should note that these improvements in living standards have been happening since 2020, when a robust recovery took hold, mostly thanks to the increase in oil revenues. The World Bank Iran Economic Monitor of 2024, which reports on the state of Iran’s economy as mid 2024, describes it as “growing for a fourth consecutive year.” This period spans the three years of Iran’s late President Ebrahim Raisi’s tenure.

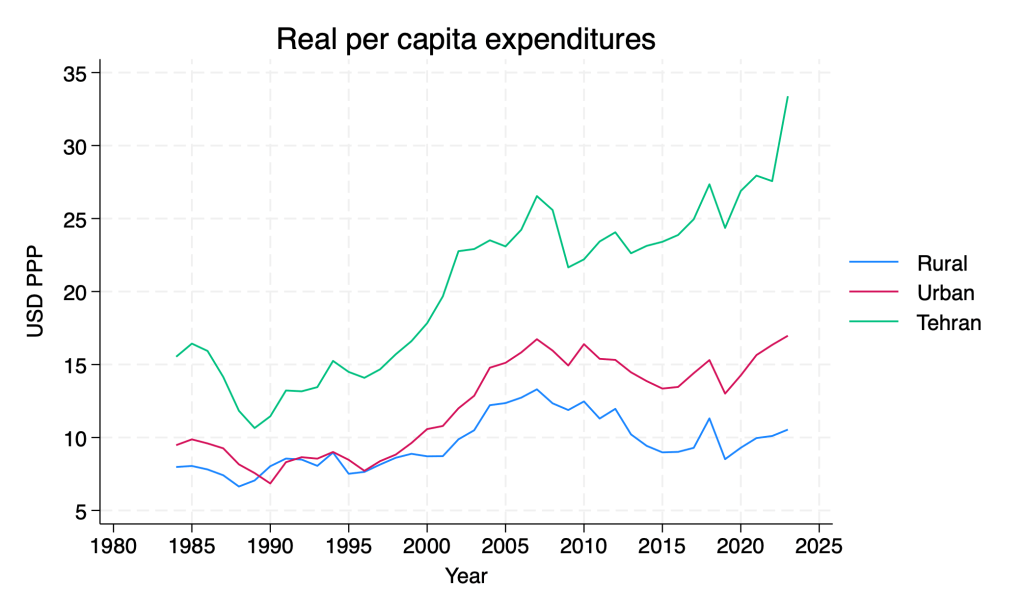

A similar picture of living standards emerges from the survey data, depicted in the graph below, which shows how real per capita expenditures (pce) has grown since 2020 by regions — rural, urban, and the urban areas of the Tehran province. The urban Tehran province and other urban areas has grown the fastest in the past three years, managing to recover their previous peaks back in 2007, while rural areas have stagnated. The longer view places recent economic performance in historical perspective, revealing how sanctions have erased the gains of the 2000s.

Figure 1. Expenditures are converted to USD PPP from 1402 (2023/24) rials using 88,593 rials per USD (WDI estimate of PPP for consumption, accessed October 24, 2024). I use separate CPIs for rural and urban areas to convert nominal values to 1402 prices.

I realize that many find the claim of a robust recovery under President Raisi hard to believe, not surprising given the preponderance of accounts on the social media casually referring to Iran’s economy as “getting worse by the day”. Rising prices naturally give the impression of a deteriorating economy, but to judge living standards one needs data on wages and other types of income, which appear to have risen faster than prices in the last three years. If reporting of inflation that registers increase in consumer prices was accompanied by the price of labor — the wage — a more realistic view of changes in living standard would emerge.

Two factors should temper the enthusiasm over rising living standards. One is that the recent increases are the product of rising oil sales to China, which may end if US exerts more pressure on China to stop importing Iranian oil. The other is the low rate of investment, which has fallen to 12% of the GDP, barely enough to maintain the existing capital stock.

On the positive side, the recovery has benefited the poor. Figure 2 shows poverty rates for the three regions, all declining from their peak in 2019. These poverty rates assume a poverty line that varies by province and rural urban location, but that averages to the World Bank poverty line for upper middle income countries, of which Iran was a member until 2019, about $7.50 using the PPP conversion factor for consumption of 88,593 rials per person per day.

Figure 2. Poverty rates are the percentage of individuals with PCE below the regional poverty lines that average to 62,1877 rials per person per day, or about $7 PPP using the PPP conversion factor for consumption of 88,593 rials per USD.

Inequality of per capita expenditures has increased very slightly since the year before, from 0.397 to 0.409, about one-third of a Gini point. Over the past two decades the Gini has vacillated between high 30s and mid 40s. What is more striking is the increase in regional inequality, observable in Figure 1 as the fanning out of the lines for the three regions. Back in the early 1990s, just after the war with Iraq had ended, average pce for rural and urban areas were about the same. In the subsequent 15 years, while all regions grew, Tehran and other urban areas diverged leaving rural areas behind. Sanctions since 2011 appear to have aided this divergence. Figure 1 shows that in 2023 Tehran’s average living standard in 2023 was 3.2 times that of rural areas, up from 2.1 in 2011.

One final note on the implications of rising household consumption concerns what is foremost on every Iran watcher’s mind today: the conflict with Israel. Iran has made it clear that it does not want a wider war, especially one that could draw in the US. Iran’s economic recovery from the Trump-era sanctions shock of 2018 helps explain its apparent reluctance to risk a destructive war that would set the country back for years, and one that Israel seems intent to start.

(Note: Graphs were corrected to include the 2023 year and rescaled with the World Bank PPP rate for consumption, on 10/24/2024)

“Figure 1. Expenditures are in 1402 (2023/24) prices, deflated by separate CPIs for rural and urban areas. For PPP USD values, divide by 700,000.”

I think a correction is needed here. The ppp conversion factor cannot be that high.

Referring to a some lines below in your piece you say:”about $7.50 using the PPP conversion factor for consumption of just under 700,000 rials per person per day.”

So the conversion factor must be about 93 thousand Rials.

Many thanks for catching my mistake. I had one zero too many. The ppp factor for 2022 is around 7k.

Sent from my iPad

You are right. For 2023/24, the conversion factor is over 9k toman. Calls for revising the estimates, though the trends remain the same.