Iran’s propsed budget for 2022/23 (1401)

This year’s proposed budget takes more significance than budgets in pervious years because it is the first by the new “principlist” (the Persian adjectives are osoulgara or enghelabi) government of President Ebrahim Raisi. It is also significant because the government is engaged in the JCPOA talks in Vienna. It is natural to read it both for signs of policies to expect from a government that has promised a radical shift in foreign and economic policy, and as it relates to the government’s negotiating position in Vienna.

A fact-based discussion of Iran's economy

As for the first reading, the potential removal subsidies is the most important change from the perspective of economic policy. There is talk of replacing the exchange rate subsidy (about 5% of the GDP) and the more extensive energy subsidies (about 10% of the GDP) with cash transfers, neither of which have been approved, but, if they are, will change the revenue side of the budget significantly. It would also be an ironic twist for a conservative administration with an anti-market reputation to take on price reform that its “neo-liberal” predecessor shunned.

As it relates to Vienna negotiations, as a highly contractionary budget, it signals that the new administration is not expecting much from sanctions relief. The total expenditures are expected to rise by less than 10% in nominal terms over 2021-2022 (that is, over the parliament-approved version; the increase over the proposed budget is 62%). Given inflation, if the parliament does not increase the allocations, expenditure will decline by 25-30% in real terms. Public wages and salaries are set to increase by 10% on average, with larger increases for lower paid employees, which implies large decreases in real wages.

A contractionary budget has its own implications for the future of the economy under sanctions. If domestic demand declines in real terms, as I expect it would with this budget in place, domestic output can only grow if demand for exports increases. With sanctions in effect, Iranian producers will not have enough access to global markets to let GDP to grow by anything other than very modest growth — like the 2-3% forecast by the IMF and the World Bank. The 8% reportedly claimed by the Management and Plan Organization head is only possible if demand — domestic or external — grows.

The budget appears to assume that oil exports remain at this year’s level, about 1.2 million barrels per day, and that a price of $60 per barrel will prevail. With these assumption the oil revenues in the proposed budget (4,084 billion rials in Table 1 below) implies an accounting exchange rate of 150,000 rials per USD, which is about half the free market rate. But the 1.2 mbd of exports in not consistent with either scenario of success or failure in Vienna. If a new agreement is reached and sanctions ease, Iran should be able to export more than 2 mbd, and if the talks fail tougher US sanctions are unlikely to allow exports of 1.2 mbd.

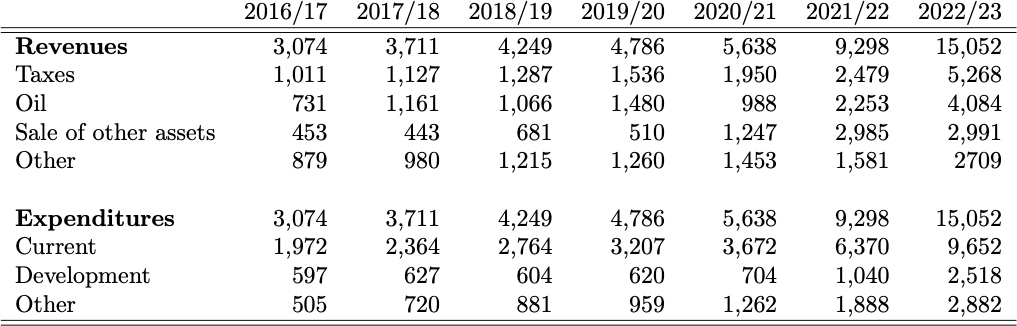

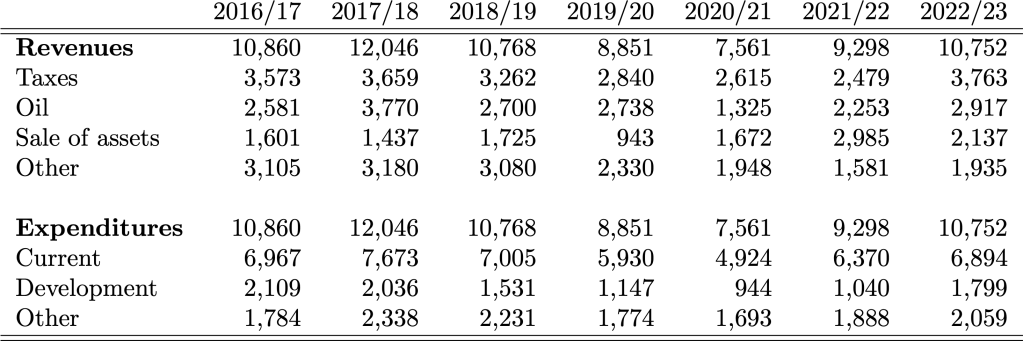

The tables of proposed budgets for the past several years in current (Table 1) and constant 2021/22 prices (Table 2) follow. Table 2 shows how expenditures have declined in real terms until 2020/21 and then picked up but it is still below the peak of 2017/18, before Trump re-imposed sanctions. Development expenditures, which rarely reach their target in practice, fell by more than 50% after Trump’s assault on Iran’s economy. It has recovered some of its decline since 2020.

Correction: A better-informed reader than I mentioned that the assumed exchange rate in the budget is 230,000 rials to the dollar, not the 150,000 I had calculated by dividing up the dollar earnings by the number of barrels. The informed reader noted that if I subtract from the 1.2 mbd of oil exports 20% for share of the National Development Fund and 14.5% for the NIOC, the implied exchange rate would be 230,000 as the press has reported.

Thank you very much for sharing your thoughts on President Raisi’s 1401 budget. As you’ve rightly pointed out, realization of revenues from oil exports is considered as given and assured. Its important to note that international oil prices are underestimated in the budget.

Thank you Dr. Barkeshli for your comment. Oil prices have risen recently but as you know they can drop if the pandemic takes a turn for the worse and slows down demand in East Asia. There is more uncertainty in the world oil market than it the past.

From: Tyranny of numbers Date: Thursday, January 20, 2022 at 4:09 PM To: Salehi-Isfahani, Djavad Subject: [Tyranny of numbers] Comment: “Iran’s propsed budget for 2022/23 (1401)”

Thank you Dr. Barkeshli for your comment. Oil prices have risen recently but as you know they can drop if the pandemic takes a turn for the worse and slows down demand in East Asia. There is more uncertainty in the world oil market than it the past.