Inflation is down but hold the cheer

The latest inflation figures for the Iranian month of Mordad that ended on August 20 show that the Consumer Price Index (CPI) rose by a modest 1.16%, which translates into an annual rate of 14.9%, or less than half of the recent annual rate of inflation. The month before prices rose at an annual rate of 18.4%, which is also way down from the 49.7% increase Iran experienced in June.

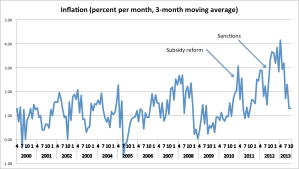

Is this beginner’s luck or the result of a change in policy? Probably something of both. No policy has had time to take effect yet because, as the data shows (see graph below), the decline started in late June, well before Rouhani was inaugurated (the new head of the Central Bank took over just two weeks ago).

Source: The Central Bank of Iran.

But at the same time one could argue, as I have, that Rouhani’s clear statements of his policy objectives that helped ease inflation is real policy. There is no doubt that his early emphasis on his primary objective — resolving the nuclear dispute — helped strengthen the rial and lowered inflationary expectations, redirecting deposits to the banks and away from expenditures. But still, these are not policies in the strict sense of the term and we have to wait to see what sort of imaginative actions Rouhani’s new team will take with respect to the two toughest sources of inflation: the deficits in the Maskan Mehr (MM) and the Targeted Subsidy Reform (TSR) programs.

The TSR, which combined energy price reform with cash transfers, did cause a sharp jolt in prices in 2011, but that was two and half years ago and its inflationary impact has disappeared by now. The higher energy prices have been fully absorbed into the price level by now and cannot be a source of inflation anymore. In fact, constant energy prices have been a source of moderation on inflation in the last year or so. In addition, the new economy minister, Ali Tayyebnia, recently noted that the deficit in the TSR amounts to 100 trillion rials, which is less than 5% of the total government expenditures for the current year (1392 = 2013/2014), and therefore cannot be a major source of expansion in liquidity. You would think that these two simple facts would stop people from continuing to blame this well-intentioned if poorly implemented program for everything that has gone wrong in Iran in the last few year, from inflation to the “loss of value of the national currency” to national laziness.

The MM program is a different story. Tayyebnia has blamed it for half of the increase in the monetary base — read liquidity– which means that it is a big item on the list of things that continue to fuel inflation. This program, unlike the TSR has no easy fix, unless the government kills it.

There are reasons why one should not be too surprised at inflation moderating and therefore not cheering too early for Rouhani’s economic team. There is no reason for inflation to be increasing when the exchange rate and energy prices are fixed, global food prices are heading down, and one large deficit-based government program — TSR– is winding down. There is every reason for inflation to have fallen back to its trend level, as it has in the last decade after every shock. The most striking feature of the pattern of price movements in the above figure is that after each shock the inflation rate has dropped back down to its steady state level below 20%: the oil income increase of 2006, the TSR in 2011 and the rial collapse of 2012.

So the falling inflation rate from 50% is the easy part. The real challenge is to bring the trend level itself down, from around 15% to 5%. It is an even bigger challenge to do so without depressing employment, which is where those imaginative polices that we are waiting to see come into the picture.

Interesting posts you post on your blog, i have shared this article on my twitter

[…] fall before Rouhani took office. For the past three months, the average rate of inflation has been below 20% annually, about half of what it was in the months […]

[…] fall before Rouhani took office. For the past three months, the average rate of inflation has been below 20% annually, about half of what it was in the months […]

Is there any particular reason why you single out Rouhani’s speeches as determinative factor in ‘managing people’s expectations’? Much more striking to me at least, is the practically immediate change in tone of both internal and foreign media. When you stop printing horror stories, people stop worrying as much.

No particular reason, but the media reports followed his pronouncements and were therefore not independent events.

Very interesting. But I didn’t understand why managing the inflation expectation of people couldn’t be considered as “real policy”, indeed for me it seems the only way of changing the trend level from 15% to 5% without depressing employment is by changing agents’ inflation expectations.

A good question. Managing expectations may not be considered real policy as long as it is does not based on actual fiscal or monetary decisions. In this sense it may be like beginner’s luck. And furthermore, lowering expectations below 15% is much harder than bringing it down from 40%. That would require actual policy. I have not heard anything from Rouhani’s economic team about how they are going to achieve that without hurting employment. Much of the optimism about the economy that has lowered the price of foreign currencies and lowered inflation comes from two sources: first, that Ahmadinejad’s policies were so bad that just stopping them improves the economy, and, second, that a deal with the West is in the offing. Exaggeration on both counts can cause future disappointment.