Iran’s GDP on the eve of the Israeli attack

I was planning to write an update on the state of Iran’s economy when Israel attacked Iran on June 13. For several days, it felt pointless to continue analyzing economic data — not because the data had become irrelevant, but because war had pushed the economy off center stage. Monitoring economic trends had mattered when Iran’s economic condition shaped its geopolitical posture. At that time, I saw value in challenging distorted narratives, those claiming that the economy was teetering on the brink of collapse — perhaps to justify preemptive military action — as well as those claiming Iran was thriving under sanctions, a blessing as some hardliners in Tehran liked to describe them.

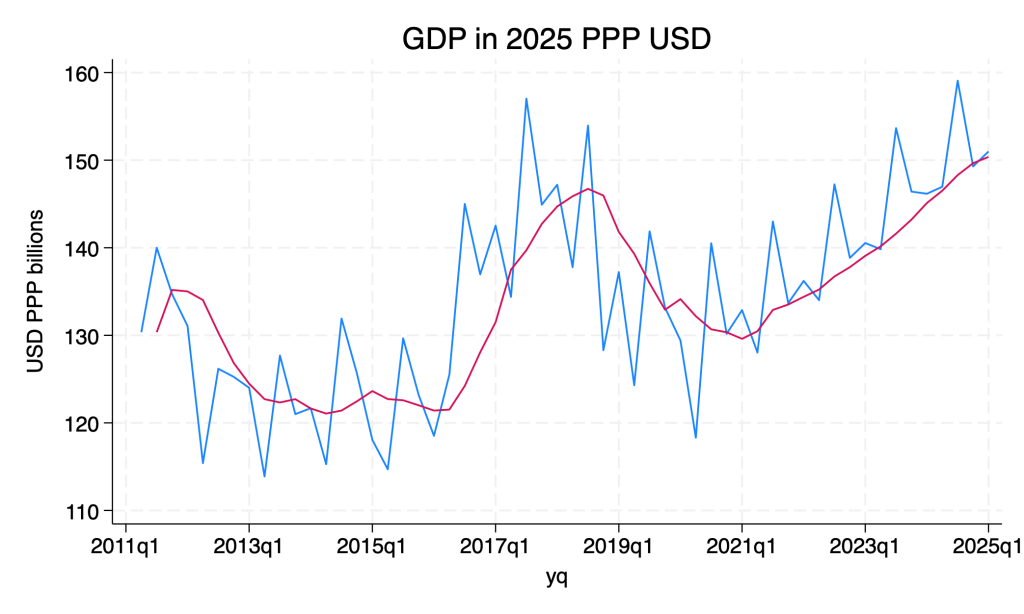

Now, with the war (hopefully) behind us, I see renewed value in publishing a graph that challenges assumptions about Iran’s economic strength — assumptions that may have influenced perceptions of its capacity to wage war. Updated GDP data suggests the economy was in fact growing in the last quarter before the conflict.

In our recent co-authored book, we argue that, “Instead of sanctions offering an `alternative to war,’ [they] have shown that they could be a cause of war.” The June 13 war may support that view. But it’s less clear how. It certainly doesn’t support the idea that sanctions had so weakened Iran that it invited attack. No one should underestimate the ignorance — or arrogance — of some Western policymakers and media voices, especially among the hawks. But the data tells a more nuanced story.

The relationship between sanctions and war is complicated. At one extreme, sanctions that severely damage an economy might lead to war because the sanctioned state becomes too weak to resist — or they might prevent war by forcing surrender at the negotiating table. At the other extreme, if the sanctioned country is thriving — say, growing at the 8% annual rate often projected in Iran’s development plans — its adversaries might strike early to prevent its rise, or hold back fearing a stronger retaliation.

As the graph below (Figure 1) shows, Iran’s economy in the months before the war was doing neither: not collapsing, not booming — just recovering from the shock of President Trump’s 2018 withdrawal from the nuclear deal and the launch of his “maximum pressure” campaign.

The relationship between sanctions and war is complicated. At one extreme, sanctions that severely damage an economy might lead to war because the sanctioned state becomes too weak to resist — or they might prevent war by forcing surrender at the negotiating table. At the other extreme, if the sanctioned country is thriving — say, growing at the 8% annual rate often projected in Iran’s development plans — its adversaries might strike early to prevent its rise, or hold back fearing a stronger retaliation.

As the graph below (Figure 1) shows, Iran’s economy in the months before the war was doing neither: not collapsing, not booming — just recovering from the shock of President Trump’s 2018 withdrawal from the nuclear deal and the launch of his “maximum pressure” campaign.

So why did Israel strike when it did?

If Iran’s economy were truly in freefall, as many Western analysts and journalists suggested, wouldn’t Israel have had time on its side? Why not wait until sanctions finished the job? The fact that it didn’t may suggest the opposite: Iran was not easily crushed by sanctions — only slowed. Perhaps the failure of sanctions, just as much as their success, can be a cause of war — but for entirely different reasons.

Here’s the graph with the latest GDP data, including projections through the Iranian year 2024/25 (ending March 20, 2025):

Notes: The red line is the smoothed quarterly data. Iran’s GDP is in constant 2021 rials, as reported by the Statistical Center of Iran, but displayed in PPP USD values (using the most recent rate published by the World Bank, about 90,000 rials). These figures are different from the World Bank’s own PPP series, which more accurately reflect Iran’s production relative to that of other countries but are not updated regularly and are not quarterly.

Given that the energy security of the world is promised and proved (also adapted the supply chain) by the U.S during the sanctions, isolation of Iran in this war was possible with the global consent. It is China challenging their calculations, a good channel keeping Iran oil still relevant for the world economy. War was inevitable as the hardliners were able to manage the bigger share of the economy and showing resilience, not letting go of their promised plans.

It would be great if you could write about Iran’s war economy, as the looming threats of conflict still persist.

As a half-serious comment, only mining bitcoins can explain the growth in Figure 1, given the electricity shortage among others!

A more serious comment concerns 1 $ PPP= 9000 Tomans, given that the exchange rate is ten times higher.

So, roughly it implies that goods and services are 10 times cheaper in Iran than the US? Is that reasonable?

Thank you for our comment. The point of the post is to show the trend and how it relates to the Israeli calculations leading to the attack. The trend in a fixed price series, as I am sure you know, does not change if you use a different exchange rate for the level. As to whether the WB PPP rates is reasonable for the level, you can ask the WB. I think it is far better than the free market exchange rate.

Get Outlook for Mac https://aka.ms/GetOutlookForMac