Trump’s return shocks Iran’s currency and prices

With Trump’s return to power, Iran is bracing for another round of maximum pressure. The rial has already fallen by one-third in the unofficial free market since last November, when his victory was announced. As before, the sharp devaluation has quickly translated into higher prices and rising social tensions.

Last month’s inflation report (for the Iranian month ending on February 20) showed that the Consumer Price Index (CPI) had risen by 4.1%—an annualized rate of 62%—double the rate of increase just two months earlier.

Iran relies on imports of food and essential industrial components, which is why devaluation drives up local prices. It also has a thriving border trade, both legal and illicit, allowing Iranian producers to profit from the rising value of the U.S. dollar. The recent spike in potato prices, which has sparked public outrage, is likely more a consequence of the rial’s depreciation than the government’s budget deficit. Food prices, which rose faster than the average inflation rate last month, are felt more acutely by consumers than the more gradual increases in the price of services, such as school tuition.

Increased public dissatisfaction comes at a particularly inopportune moment, as Iranian leaders seek to project an image of national unity and resilience in the face of Trump’s renewed economic pressure.

The reason prices have not risen in direct proportion to the rial’s decline in the free market is that only a fraction of foreign exchange transactions occur there. Iran has several exchange rates, including a soon-to-be-fully-phased-out rate of 42,000 rials per USD, a preferential rate of 28,000 rials for essential goods, and a managed market rate—currently at 550,000 rials—where importers and exporters trade. These implicit foreign exchange subsidies help keep the prices of staples like wheat and fuel well below international levels. The government, which earns most of the country’s foreign exchange through oil exports, uses its currency reserves as a tool for social protection.

As a result, when Iranians lament the plight of the national currency, they are thinking about the cost of spending abroad—imagining their purchasing power in European capitals—rather than where they actually spend their incomes — in the local markets, where prices remain significantly lower than the free market exchange rate would suggest.

For many in Iran’s middle class, buying U.S. dollars isn’t just a financial move—it’s a survival strategy, whether to support relatives abroad, prepare for future emigration, or simply protect their savings from inflation. While the rising dollar may not immediately shrink the typical middle-class family’s food basket, it undoubtedly crushes their dreams.

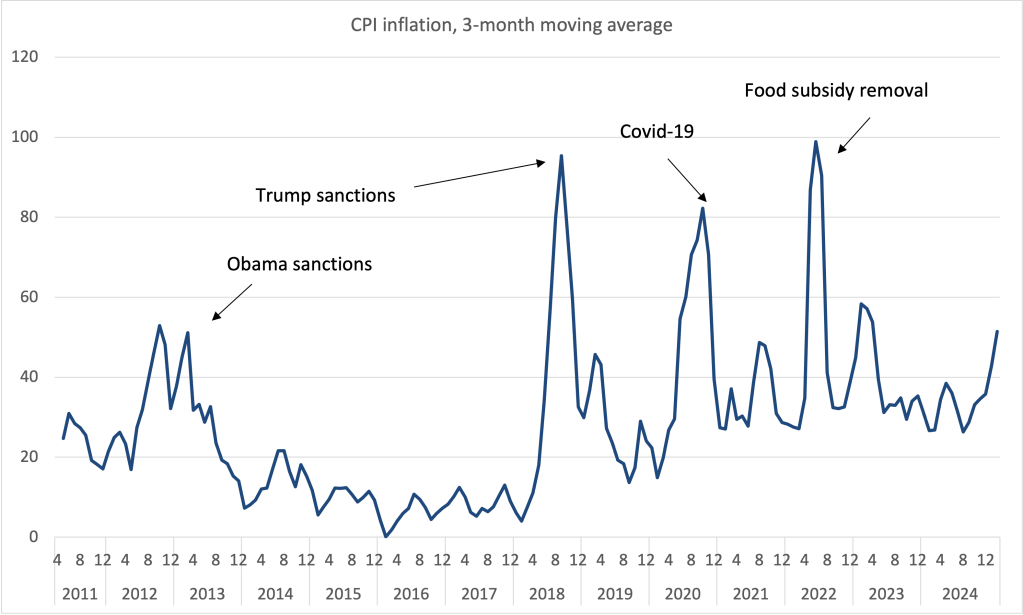

To grasp the immense uncertainty and the roller-coaster existence of the average Iranian, one need only look at the two graphs below — one illustrating the fluctuations of inflation and the other depicting the external shocks that rock the currency.

Viewing inflation on a monthly basis — rather than the smoother annual or point-to-point data used in official reports — reveals the dramatic shifts in the cost of living that have occurred since 2011, when sanctions injected the uncertainty in Iran’s foreign relations into the economy. No amount of searching for these fluctuations in the budget deficit or expenses of religious establishments finds an explanation for the fluctuation in inflation.

Political uncertainty seeps into local prices through shocks to the currency, which is why the RER graph below moves in tandem with inflation.

The sharp rise in the RER over the past few months—clearly visible in the final section of the graph—indicates that the price of USD in the (narrow) free market has outpaced inflation. This serves as clear evidence of the external shock triggered by Trump’s ascendance to power, and highlights why macroeconomic management under sanctions is shaped less by economic philosophy and more by political uncertainty and external constraints.

leave a comment